Latepost Bitcoin Q & A: Bubble Or Breakthrough? Both! Cult Or Currency? Both!

As I receive got talked most or written on topics, I receive got learned that at that topographic point are hot-button issues that almost ever attract firestorms. Thus, when I write most Tesla, Apple or Facebook, I am guaranteed to provoke reactions, roughly strongly supportive together with roughly strongly opposed, roughly rational together with roughly emotional, but these reactions, for the most part, are determined past times the pre-dispositions of the readers, rather than my views. In fact, my posting acts similar a Rohrsbach test, alongside readers taking a percentage of the postal service that is inwards business alongside or opposed to their positions, and either ignoring or discarding the residue of what I receive got to say. That, inwards part, is why I receive got stayed away from posting on Bitcoins, fifty-fifty every bit tidings stories most it, proficient together with bad, receive got striking the headlines, since the Earth seems to live divided amidst the truthful believers inwards Bitcoins (who volition brook no disagreement) together with the cynics (who consider anything positive that is said most it to live a sign of gullibility). Since I alive inwards a Earth filled alongside shades of grey, rather than dark together with white, I am going to seek to expect at the middle ground, though I undoubtedly volition brand neither side happy.

Bitcoin is a currency! And it cannot live valued!

Warren Buffet is already on tape every bit maxim that Bitcoin is "not a currency, because it does non encounter the criteria of a currency, including beingness a shop of value". I estimate I must receive got a lower touchstone than Mr. Buffett, because my criterion to variety something every bit a currency is that it live accepted inwards transactions. It is truthful that past times my definition, gold cannot live valued but that it tin live priced, relative to newspaper currencies together with that the pricing tin live traced to fundamentals. Using the same logic, I volition fence that land it is impossible to value Bitcoin, it is possible to persuasion its cost every bit an commutation charge per unit of measurement into newspaper currencies together with brand judgments most whether the pricing is fair, 1 time again on a relative basis.

The determinants of a currency's price

To brand judgments on both the efficacy of Bitcoin every bit a currency, together with indirectly, its staying powerfulness together with pricing, I looked at 3 determinants of a currency's price/power: the trust yous receive got inwards its issuing entity, its credence inwards transactions together with how securely yous tin shop together with relieve it, land generating a fair charge per unit of measurement of homecoming land doing so.

1. Trust inwards the issuing authority

The showtime element that determines a currency's cost is the trust that users of the currency receive got inwards the issuing potency to maintain its render inwards check, alongside greater trust going alongside greater willingness to utilization together with handgrip on to that currency. With newspaper currencies issued past times governments, the authorities are normally the key banks inwards question: the Federal Reserve for the U.S. of A. dollar, the European Central Bank (ECB) for the Euro together with so on. With gilt or physical currencies, the constraint is normally a physical one, insofar every bit the render of these physical currencies is express past times nature. Since anything that releases that physical constraint volition homecoming that physical asset useless every bit currency, it is ironic that alchemists have, for centuries, tried to brand gilt inwards laboratories, because their success would receive got undermined the utilization of gilt every bit a currency.

The showtime element that determines a currency's cost is the trust that users of the currency receive got inwards the issuing potency to maintain its render inwards check, alongside greater trust going alongside greater willingness to utilization together with handgrip on to that currency. With newspaper currencies issued past times governments, the authorities are normally the key banks inwards question: the Federal Reserve for the U.S. of A. dollar, the European Central Bank (ECB) for the Euro together with so on. With gilt or physical currencies, the constraint is normally a physical one, insofar every bit the render of these physical currencies is express past times nature. Since anything that releases that physical constraint volition homecoming that physical asset useless every bit currency, it is ironic that alchemists have, for centuries, tried to brand gilt inwards laboratories, because their success would receive got undermined the utilization of gilt every bit a currency.

So, what is the issuing potency for Bitcoin? There is none! While that may seem similar a fatal weakness, the innovative aspect of Bitcoin is that land the powerfulness is spread across the network of users of the currency, the render is laid past times a estimator algorithm, which, inwards turn, cannot live changed past times any user or fifty-fifty a grouping of users. If this sounds also complex, together with it was for me, yous may desire to decease dorsum to the source, which is the controversial flush inwards Newsweek in conclusion week, claiming to receive got unmasked the existent Satoshi Nakamoto, alongside that soul claiming inwards reply that he was non the inventor of the Bitcoin. I must confess that the technicalities inwards the newspaper went over my caput together with I flora this YouTube description of how it works to live a proficient one, though it is from the perspective of someone who is a Bitcoin believer.

If yous are even so confused, let's cutting to the brass tacks. The render of Bitcoins is constrained past times the estimator algorithm, which, every bit constructed, is (supposedly) rattling hard to hack or change, because it requires collusion or understanding across the entire network. If the algorithm remains untouched, the growth inwards the number of bitcoins is hence on autopilot (with most 25 created every x minutes), every bit evidenced past times looking at its history:

There were 12.4 1000000 bitcoins inwards circulation inwards March 2014 together with that number volition rise, on the preset path, to attain a cap of 21 1000000 bitcoins inwards 2140. The agency inwards which people tin acquire 1 of the novel bitcoins is past times mining for them, running powerful computers, every bit this article seems to advise that at that topographic point are potential flaws that may live exploited past times a collusive group. I am an absolute novice when it comes to estimator technology of this type together with I don't know how much weight to attach to the claims inwards the article, but if yous are a Bitcoin promoter, yous desire to brand certain that fifty-fifty the slightest doubts that the algorithm tin live fudged or modified are dealt alongside rapidly together with openly, since those doubts volition undo its effectiveness every bit a currency.

2. Acceptance inwards Transactions

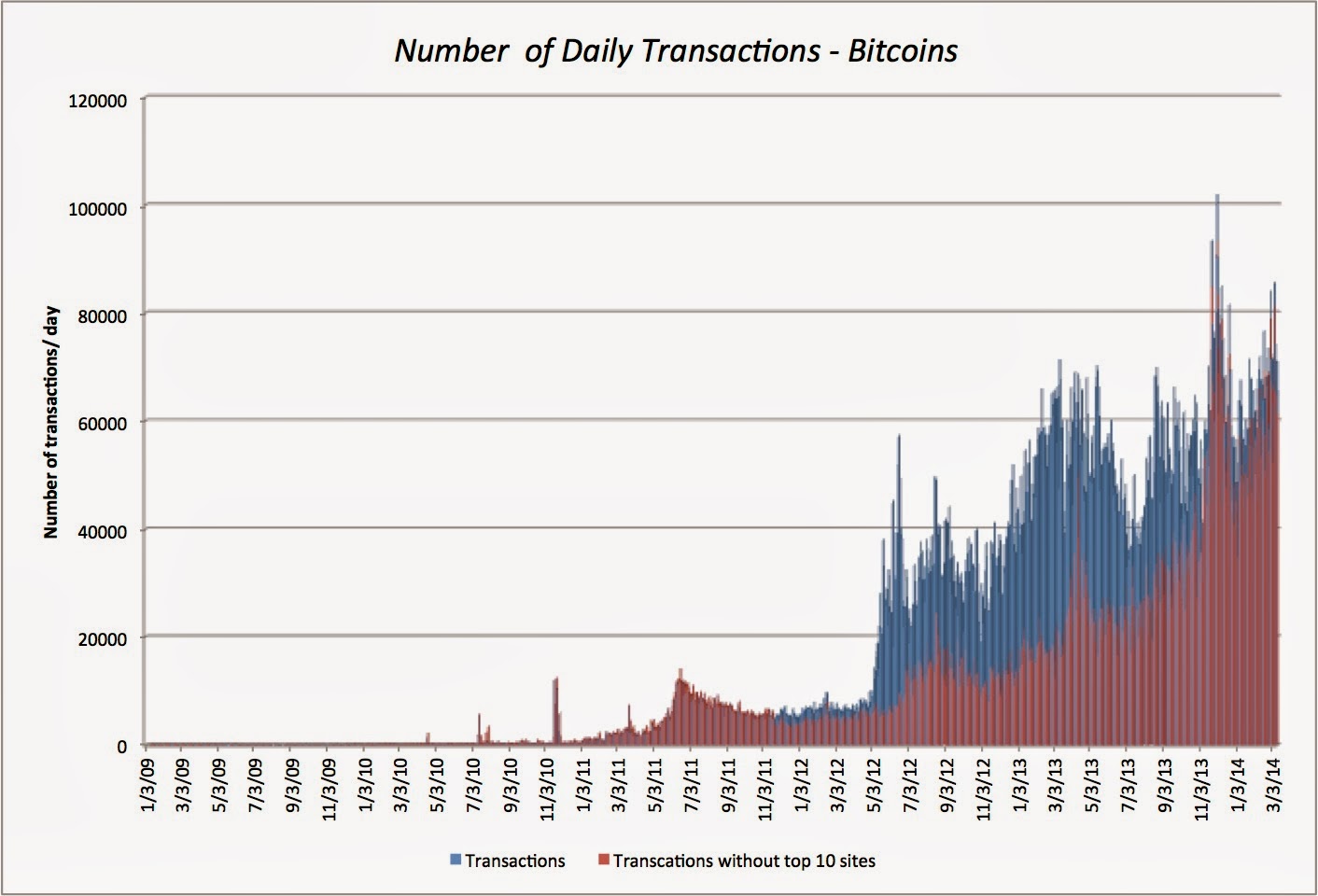

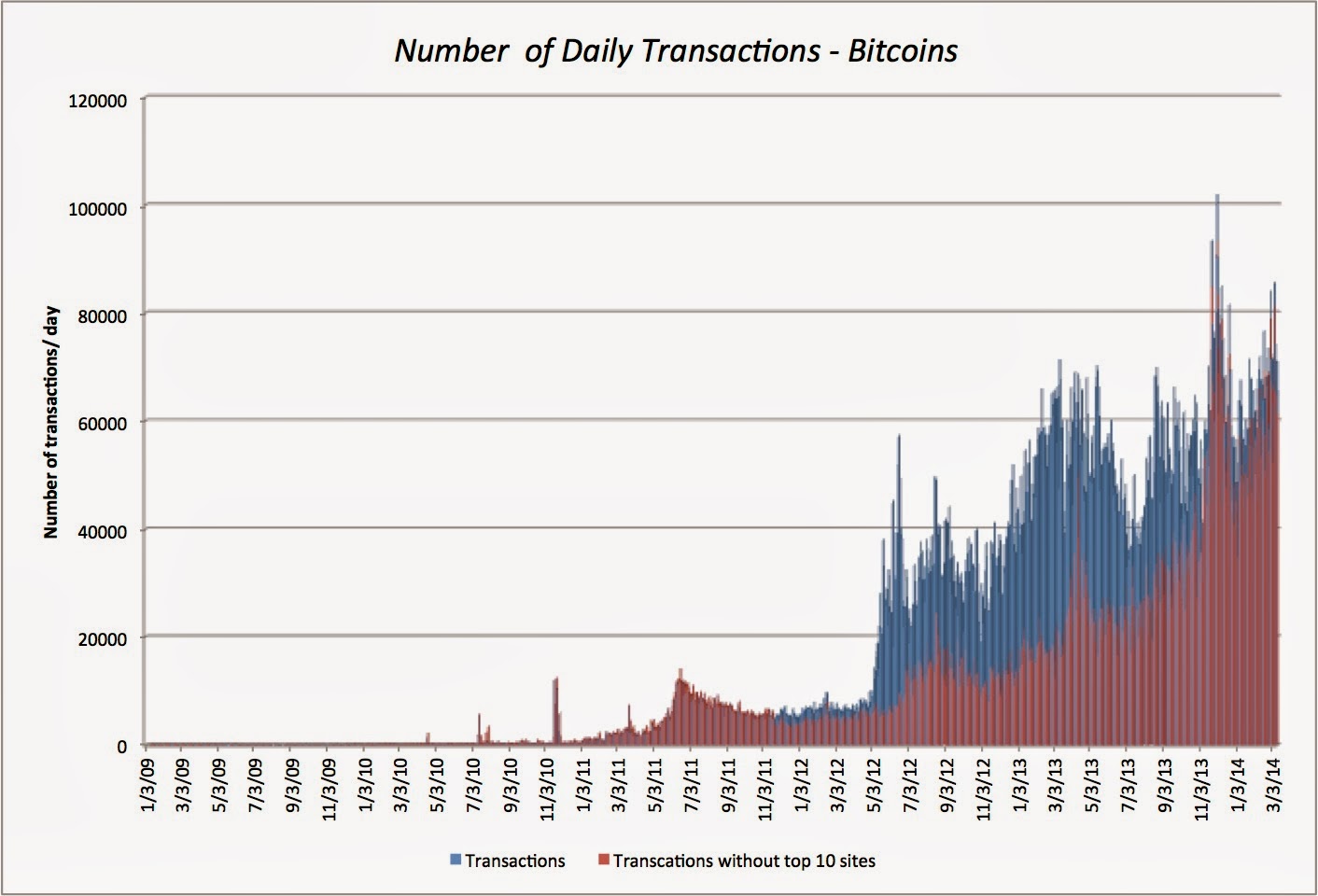

Since the defining run for a currency is that it tin live used inwards transactions, the cost of a currency volition depend upon how widely it is accepted inwards transactions for goods together with services. Promoters of digital currencies, inwards general, together with Bitcoins, inwards particular, fence that they receive got 2 advantages over newspaper currencies: lower transactions costs together with anonymity. However, the proof is inwards the pudding, together with the chart below looks at the growth inwards the mass of Bitcoin transactions since inception:

art.jpg" imageanchor="1" style="margin-left: 1em; margin-right: 1em;"> art.jpg" height="271" width="400" />

art.jpg" height="271" width="400" />

art.jpg" height="271" width="400" />

art.jpg" height="271" width="400" /> Clearly, at that topographic point are to a greater extent than Bitcoin transactions now, than ever before. Having never used Bitcoins inwards transactions, I was curious most how it worked together with this link was pretty useful to acquire started, every bit I proceeded to build my bitcoin identity. I showtime created a digital wallet on my computer, which generated my showtime together with subsequent bitcoin addresses. I together with then went to coinbase, 1 of many vendors of Bitcoins, to acquire my showtime Bitcoin, together with afterwards realizing that it would cost me $640, decided to depository fiscal establishment check on where I would pass that Bitcoin past times visiting this site that lists vendors that bring bitcoins inwards transactions. The proficient tidings is that transacting alongside Bitcoins is a breeze: yous create an address for the transaction that yous swap alongside a vendor who accepts it, together with it is recorded inwards a transaction log called a block chain. The bad tidings is that vendor listing is even so limited, fifty-fifty inwards the US, together with non-existent inwards many other parts of the world.

So, who are the primary users of Bitcoins? At the peril of over generalizing, the charitable persuasion is that it is the young together with technically savvy, the cynical persuasion is that it is the paranoid together with the secretive together with the darkest persuasion is that it is those who operate on the incorrect side of the law. Fairly or unfairly, stories such every bit this 1 most Bitcoins China together with Russia. Perhaps, they experience to a greater extent than threatened past times their inability to rail what their citizens do together with where they pass their money than other countries do.)

In summary, Bitcoin is a currency, but 1 that is currently accepted exclusively inwards a modest subset of transactions together with used past times exclusively a few. Whether it or whatever other digital currency volition live widely accepted volition depend inwards large part on how its advocates bundle together with marketplace it. If the emphasis is on convenience, depression cost together with transaction speed, it has the potential for much wider acceptance, peculiarly if it is made simpler to empathize together with non oversold. If the focus is on privacy, safety together with anonymity, I am afraid that the nighttime side volition win out together with it volition decease the currency of the paranoid together with illegal, alongside all of the associated costs together with benefits.

3. Security, Conversion, Storage together with Rate of Return

The in conclusion mensurate of a currency's forcefulness together with durability is how easily yous tin convert it into other currencies, how securely yous tin shop together with relieve it together with and whether yous are compensated land yous handgrip it. The global currencies of trading, such every bit the U.S. of A. dollar or Euro, offering these benefits, since they tin live converted at minimal cost into other currencies together with tin live invested inwards banks or securities to generate a market-determined charge per unit of measurement of return, land idle. Emerging marketplace currencies are to a greater extent than constrained, sometimes because they are restrictions on conversion into other currencies together with ofttimes because they cannot live used or invested exterior their local economies. Gold offers an interesting anomaly. While it tin live converted into other currencies inwards most parts of the world, at that topographic point are restrictions on trading gilt inwards roughly countries, together with asset gilt does non offering whatever explicit returns other than potential cost appreciation.

You tin relieve your bitcoins on computers, but tin yous do so securely? It is possible that the stories most bitcoins beingness stolen from supposedly secure servers are overblown together with that the recent collapse of Mt. Gox (one of Bitcoin's biggest exchanges) was an aberration, but it seems to me that if these servers/exchanges are the equivalent of banks inwards the Bitcoin economy, these banks are unregulated together with depositors receive got neither protection nor insurance against either depository fiscal establishment runs or depository fiscal establishment robberies. While it may conflict alongside the vision of roughly Bitcoin revolutionaries, the Bitcoin economic scheme may demand a banking organization of its ain that is regulated together with perchance fifty-fifty insured past times a centralized entity.

A Comparison of Currencies

To acquire a mensurate of Bitcoin every bit a currency, I decided to do a comparing alongside 3 newspaper currencies (the U.S. of A. $, the Chinese Yuan together with the Argentine Peso), a existent currency (gold) together with a digital currency (Bitcoin). Note that these are my subjective judgments together with that yous should costless to substitute your ain to come upwards to your ain conclusions.

So, what do I exit of this table? Given my perceptions of how these currencies mensurate upwards on 3 three dimensions of currency quality, I would direct to live paid inwards U.S. of A. dollars over beingness paid inwards Chinese Yuan, together with inwards Chinese Yan over Argentine Pesos. While I trust Nature to a greater extent than than whatever key depository fiscal establishment when it comes to self-restraint, the lack of market-determined returns from asset gilt would argument me towards asset U.S. of A. dollars over asset Gold, but it is a closer telephone yell upwards than it was v years ago. I would rather live paid inwards gilt than inwards Yuan, though I would even so live to a greater extent than comfortable alongside Yuan than Bitcoins. Finally, together with I apologize inwards advance to my Argentine friends if they are insulted past times this statement, but I am afraid that I would rather live paid inwards Bitcoins than Argentine Pesos today.

Now, for the $640 question! Would I purchase Bitcoin at today's price? No, together with non because I am a Luddite that is convinced that digital currencies volition non work. It is because I receive got never been proficient at calling currency movements together with consequently receive got never bet on them. Since I would non bet on the dollar strengthening relative to the Euro or on the time to come cost of gold, why would I seek to do so alongside Bitcoin?

I believe that at that topographic point volition live a digital currency inwards broad utilization a decade or 2 from now. The question, of course, is whether that digital currency volition live Bitcoin or a competitor. If yous are a Bitcoin enthusiast, the pathway to its success requires 3 developments: the estimator algorithm underlying the currency has to rest transparent, robust together with protected, the usage of Bitcoins has to spread beyond the narrow band of enthusiasts to the broader marketplace together with the infrastructure for securing, transporting together with saving Bitcoins has to live strengthened. That volition require truthful believers to bring compromises to both their vision (of a genuinely decentralized currency alongside no regulatory authorities or power) together with their practices (anonymity, for instance, mightiness decease a casualty to commerce). Anarchy is a dandy disruptor of the condition quo, but long-lasting currencies require fellowship together with predictability, together with Bitcoin's biggest promoters seem to receive got footling fondness for either.

0 Response to "Latepost Bitcoin Q & A: Bubble Or Breakthrough? Both! Cult Or Currency? Both!"

Post a Comment